[UPDATED] GST Rules for Freelancers, Bloggers and Digital Marketers in India.

Updated: 12 Oct, 2017

A big relief to online entrepreneurs who were shutting down their business because of GST complexities.

A small scale freelancer who was earning about 100,000 rupees per year can not hire a CA who will charge thousands of rupees to keep GST compliance.

Government amended certain rules to help startup level entrepreneurs.

Key Highlights

- Exemption from GST registration if aggregate turnover is less than 20 Lakh per year (10L for special states)

- 20L exemption rule is application even for inter-state services (Adsense and Affiliate Marketing etc)

- Quarterly filing of GST returns

I waited for this rule till September but government pushed everyone to apply for GST. I was afraid of losing business from my clients who were asking me to provide GST number so that they can get GST expenses as input credit.

I applied for GST but you can avoid GST compliances if your annual income is below 20L.

GST is replacing the service tax that online entrepreneurs used to pay earlier in which there was an exception until the income hit the 10L annual revenue from service business.

Let me explain everything in the most simple way from my personal understanding. You can consult your CA for the legal taxation advice.

Services outside India

Export income is still exempted from the GST. Goods and Services provided to foreign clients is considered an export.

For example, if you are an affiliate marketer whose entire income comes from a foreign registered company, then you don’t have to collect GST. In most of the cases, export income comes through Paypal or wire transfer from the clients.

You still have apply for GST, like you have to file income tax returns even though you don’t fall under tax bracket.

You have to file GST returns for 0% GST. There would be two options

#1. Claiming refund on GST payments for export services

#2. Furnishing bond or Letter of Undertaking for export services.

You also have to maintain all the records of your business because the authorities can ask you for the details of your business anytime.

Services within India

But my dear friend, if you get any income from a company registered in India, then you have to worry about registering for GST as soon as possible.

The standard rate of GST is 18% for services provided online – like writing, designing, digital marketing and advertisements.

You have to collect GST from your clients and deposit to the Government.

There are 2 sub-components of GST

#1. Center GST – 9%

#2. State GST – 9%

In the online business world, it’s rarely a case that all of your clients are based in the state where your business is registered.

Most of the offline businesses (doctors, lawyers, architects, accountants, shops) may have all the clients in the same state, so there is one exemption for them.

Carry on reading till the end…

Exemptions for GST

You can become eligible for GST exemption upto 20L of annual turnover.

Following state registered businesses get the exemption upto annual revenue of 10L.

- Arunachal Pradesh

- Assam

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Jammu & Kashmir

- Himachal Pradesh

- Utrakhand

Which professions are eligible for GST

Freelancers – If you are a freelance writer, designer, developer or digital marketer who are providing services of more than 20L annually.

Bloggers – You have to pay GST, if you are making online income through blogging. It can be a client for whom you provided sponsored article, income from advertisements or getting a commision as an affiliate.

Affiliate Marketers – If your income comes from any affiliate marketing network based in India (Vcommision, Mindtech, Optimise, Amazon.in, Flipkart) then you have to pay GST.

YouTubers – Same as bloggers, youtubers also have to register for GST. They have to collect GST from the Indian clients (if any), and income through Adsense is exempted.

Digital Marketers and Agencies – You also have to come under GST if your business is above 20L per year.

E-commerce – Anyone selling through online market places or their own e-commerce website. No exemption.

But for how long? You have to service clients worldwide to expand your business and you have to come under GST soon or later.

One Sweet Benefit of GST

You might have heard only the bad things about GST – high tax rate, uncertainty, enforcement and headaches for small business owners.

I came to know about one benefit of GST, read carefully.

You will get refund of GST amount that you pay to your suppliers and vendors.

In simple words, GST paid on your business expenses will come back to your pocket.

For example, if you spent Rs. 10,000 on Facebook Ads and paid Rs. 1800 as GST to Facebook, then you will get that money adjusted while filing the GST returns.

Similarly, GST charged by your freelancers, broadband/telephone company, office rent and similar… will come back to your account as GST credits in your final GST returns.

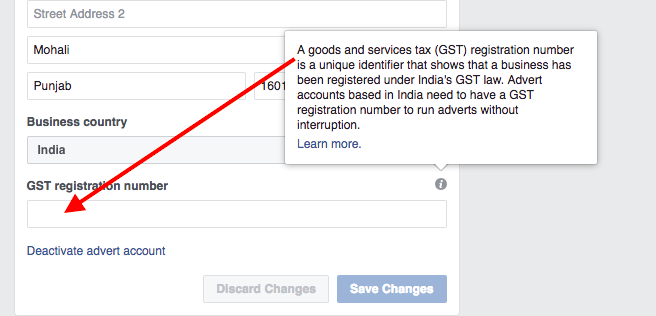

But you have to provide your GST number to these companies so that it can be tracked online.

Penalties for non-compliance

There are big penalties for non-compliance of GST rules.

At present the scenario looks like below but it may change at anytime.

- Non-registration : 25,000

- Late filing of GST return : Rs. 100 per day

- Non-tax payment or tax evasion : 10% to 100% of tax with minimum Rs. 10,000

Afraid enough?

Me too..

There is one relaxation from the Government that they will not be strict for the initial two months of GST implementation – BusinessLine also reported No Penalty for wrong entry in GST procedure.

I am availing the bonus time period to become compliant for GST norms.

Application process to get a GST number

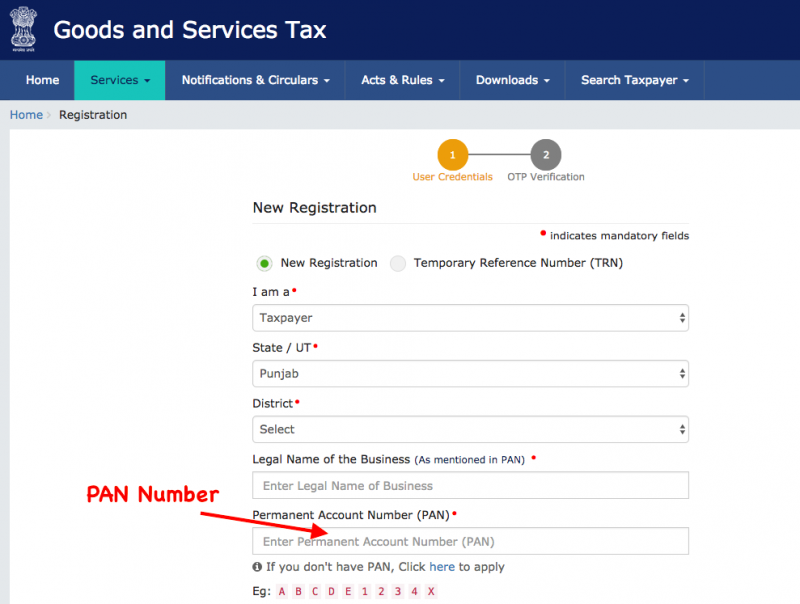

GST application process is totally online.

You can register for GST at URL – https://reg.gst.gov.in/registration/

You can start with filling up PAN number and the state where your business is registered.

If you are running a proprietor business then fill up your own name in Legal Name of Business column.

You will be allotted Temporary Reference Number and will be able to complete the application by login through OTP received on your mobile.

In the next screen, you can fill up your business name under the column ‘Trade Name’.

You have to submit the application within 15 days after you start the procedure. Be prepared to upload your documents for address/business proof.

You will get your GST number upon approval of your application. I heard that TRN number can be also be used as GST number till your application is approved.

GST Return Filing Schedule

If you have a GST Registration No. you are also required to file GST Returns every month. Even if your sale for the whole month was Rs. 0 – you still have to file GST Returns every month.

For example, for the August Business, you have to file the returns as mentioned below

- GSTR 1 – 10th Sept (Details of all sales made in the month)

- GSTR 2 – 15th Sept (Details of all business expenses made in the month)

- GSTR 3 – 20th Sept (Monthly Return and payment of tax)

It’s a WTF feeling that GST is giving us – but you don’t have any option other than filing 3 returns every month..

Conclusion

GST rules can still be changed. I will record the videos when I will file my GST returns and share with you.

I will keep you updated about the GST rules. -> (Bookmark this article & subscribe to the updates, I will update this article only rather than writing a new post every time)

I take help from my CA friend Karan Batra when in doubt – You can read his article on GST rules for reference.

Stay connected with the experts.

Author : Pardeep Goyal is founder of CashOverflow & CreditFrog, a personal finance geek who helps new entrepreneurs to earn money online through freelancing & low investment online businesses.

See What Harsh Agarwal Say’s About GST in India

Pardeep Goyal is founder of CashOverflow & CreditFrog, a personal finance geek who helps new entrepreneurs to earn money online through freelancing & low investment online businesses.