Everything to know about Taxes for a Freelancer in India

Being your own boss, working in your PJs and having the liberty to spend time at your will; those are some of the joys that come with being a Freelancer. But being a freelancer also comes with the added responsibility of filing your taxes as a business. Taxes and return filing for a freelancer is very different from the salaried.

Meet Raghav. Raghav decided to quit his job in June 2015. Design and illustration were his first love. And trappings of working as a freelancer appealed to him. He decided to set up a website and showcase some of the design work he’d done during his free time. He also registered himself on www.truelancer.com .

Pretty soon, work started coming Raghav’s way. He made a few purchases; a laptop was bought for Rs 70,000. With the laptop, he also purchased Adobe creative suite for Rs 25,000 and a font software for Rs 20,000. He took a subscription to online services to schedule blog posts on his site and a calendar service to manage his day, costing Rs 5,000 for the year. He paid website hosting charges of Rs 8,000 and a domain registration of Rs 20,000. He paid for a Netflix account to learn about design work around the world and watch some documentaries on design evolution for Rs 2,000 per annum. Since he also started getting a lot of print design requests he bought a printer for Rs 15,000. Raghav enrolled himself for a course on Coursera that will cost him Rs 10,000 per annum for 3 years.

Besides these expenses, Raghav was paying rent of Rs 8,000 per month for his 2 bedroom apartment, where one room was dedicated to his work. He paid maintenance of this apartment of Rs 27,000 in the whole year. Raghav also attended a couple of events organised for designers and spent Rs 6,000 in total for them.

Raghav had some sundry expenses, such as business cards Rs 1,000, books Rs 2,500, pens, pencils, art supplies all costing Rs 6,000. Mobile bills Rs 24,000 for the whole year and internet expenses of Rs 9,000 for the year. He spent Rs 7,000 on cabs used for meeting clients.

Raghav’s earnings in 2015-16 from the sale of his design work were Rs. 9,00,000.

Raghav is confused about how he how he should do his taxes and file his return for FY 2015-16. For the 3 months of April, May and June 2015, Raghav has salary income of Rs 1,50,000. EPF contribution during 3 months Rs 20,000. TDS of Rs 8,000 was deducted by his employer. Raghav bought life insurance for Rs 12,000 for himself and his parents. He also invested Rs 50,000 in an NPS account. He deposited Rs 80,000 in PPF. Some of the clients who paid him for his freelancing work deducted TDS of a total of Rs 40,000. Raghav also has an interest income of Rs 11,000 savings account and Rs 5,000 from fixed deposits. TDS deducted on FDs is Rs 500.

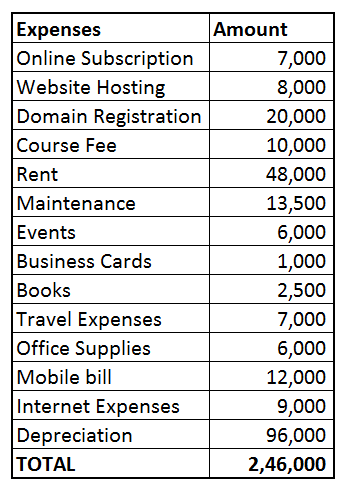

To begin with, Raghav must draw up a detail of all his expenses.

Assets purchased

Laptops, printers and other equipment whose benefits are expected to last for a longer time, usually more than a year, are ‘capitalised’. Which means instead of considering them as expenses of your business, these are called ‘assets’. Every year a small portion of their cost is expensed and is allowed to be reduced from your income. This expense which is charged every year is called Depreciation.

Depreciation rates for different assets have been mentioned in the income tax act.

Laptop Rs 70,000

Adobe Suite Rs 25,000

Font Software Rs 20,000

Printer Rs 15,000

Depreciation that can be claimed in FY 2015-16

Laptop Rs 42,000

Software Rs 45,000

Printer Rs 9,000

Total depreciation cost = 96,000

Business expenses

Freelancers can reduce expenses which are directly related to their work from their receipts. The following expenses of Raghav can be reduced from his income

Online subscription Rs 7,000(blog scheduling + calendar = Rs 5,000, Netflix account Rs 2,000)

Website hosting Rs 8,000

Domain registration Rs 20,000

Design Course Fee Rs 10,000

Rent Rs 48,000 (since half of Raghav’s house was being used as his workplace, he can claim 50% of the rent)

Maintenance Rs 13,500 (50% can be claimed as half of the premises was being used as office)

Events Rs 6,000

Business Card Rs 1,000

Books Rs 2,500

Travel Expenses Rs 7,000

Office supplies Rs 6,000

Mobile bill Rs 12,000 (Raghav checked his detailed bills for 3 months and figured about half of the calls were related to his work, and therefore he decided that 50% of the bill can be attributed to his work)

Internet expenses Rs 9,000

Direct freelancing expenses (Sum of the above) = Rs 1,60,000

Total expenses are Depreciation + Business Expenses = Rs 2,46,000

Net Earnings from DESIGN WORK = Rs 9,00,000 – Rs 2,46,000 = 6,54,000

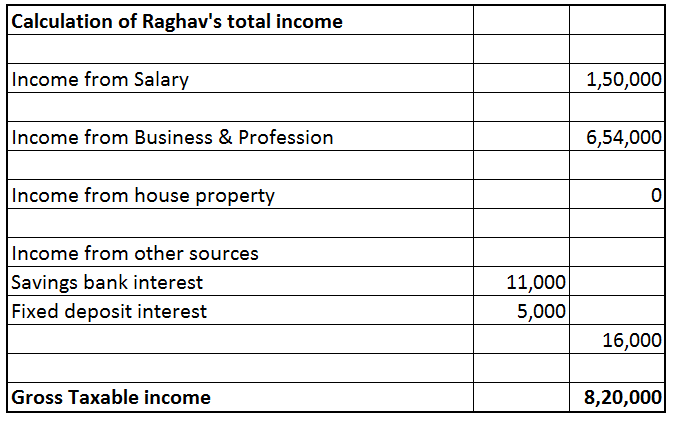

Calculating Raghav’s taxable income

Raghav’s freelancing income is Rs 6,54,000. But total taxable income is the sum of income from the following heads: Income from salary, income from house property (any rental income), income from business & profession (freelancing income), income from capital gains (sale of equity shares or mutual funds etc.), and income from other sources (Interest income from banks, deposits, etc.).

Income from Salary

This includes any income of salary or other payments received by virtue of employment. Raghav’s three month’s salary of Rs 1,50,000 was credited to his account. PF of Rs 20,000 and TDS of Rs 8,000 was also deducted before he quit his job at the end of June 2015.

Income from house property

Raghav does not have any house and has no rental income.

Income from capital gains

Raghav did not sell any capital assets during FY 2015-16.

Income from Business & Profession

Raghav’s freelancing income (income from business & profession) as calculated above is Rs 6,54,000.

Income from Other Sources

Includes income from interest on savings account, interest from fixed deposits. This is the residual head of income, incomes which cannot be taxed under any other head of income are taxed here. Raghav has interest income of Rs 11,000. He earned interest from FD also of Rs 5,000. TDS deducted Rs 500.

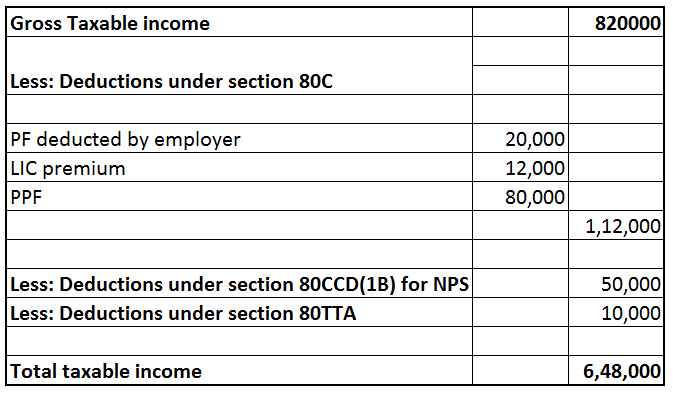

Deductions from Income

Section 80C Raghav’s contribution to his EPF account at the time of employment are eligible for deduction under section 80C = Rs 20,000. LIC premium paid by him and PPF deposit are also eligible under section 80C = Rs 12,000 + Rs 80,000. Total 80C deduction = Rs 1,12,000. [A maximum of Rs 1,50,000 can be claimed under section 80C].

Section 80CCD(1B) Since Raghav does not contribute to EPF anymore he has opened an NPS account. Deposits made to NPS are eligible for deduction under section 80CCD(1B) up to a maximum of Rs 50,000.

Section 80TTA Deduction under section 80TTA is available for Raghav for interest income from saving bank account. A maximum of Rs 10,000 can be claimed.

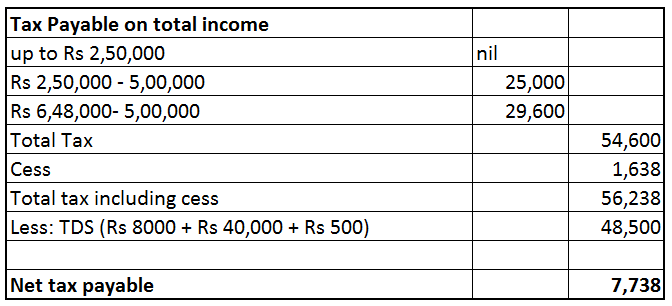

TDS

The following amounts were deducted as TDS from his various incomes. These were traced from his Form 26AS

TDS on salary Rs 8,000, TDS on freelancing income Rs 40,000, TDS on interest Rs 500 = Rs 48,500

Raghav’s total taxable income is Rs 6,48,000

Total tax payable by Raghav is Rs 56,238. However, Rs 48,500 has already been deducted as TDS. Therefore, the net tax payable by Raghav is Rs 7,738. (Since Raghav is a Freelancer, and his annual tax liability exceeds Rs 10,000, advance tax rules shall apply to him. If he did not deposit Advance Tax during FY 2015-16, he might have to pay interest under section234B and 234C).

Raghav filed his taxes using ClearTax’s product for Businesses, and you can file your returns here too www.cleartax.in/business

Do you have to deduct TDS from payments YOU make to others, we’ve got you covered, check out www.cleartds.com

Head of Product – Truelancer Prime

Technopreneur – Startup Evangelist – Food Hobbyist and a Writer.