Freelance Payment Options in Pakistan

In our previous posts about rising freelance trends in the Asia-Pacific, we saw how large the contributions of online transactions had become for the entire country’s balance sheet. The economy activity of freelancers online has rapidly increased in the recent few years because of numerous payment systems which are available on the internet.

If one looks at the statistics the extent of e-commerce penetration in Pakistan is paramount and this means that secure and accessible online payment channels are available.

This brings us to the question that how easy it is to get paid or pay on the internet in the entire Asia-pacific region. In this post, we discussed the freelance payment options in Pakistan.

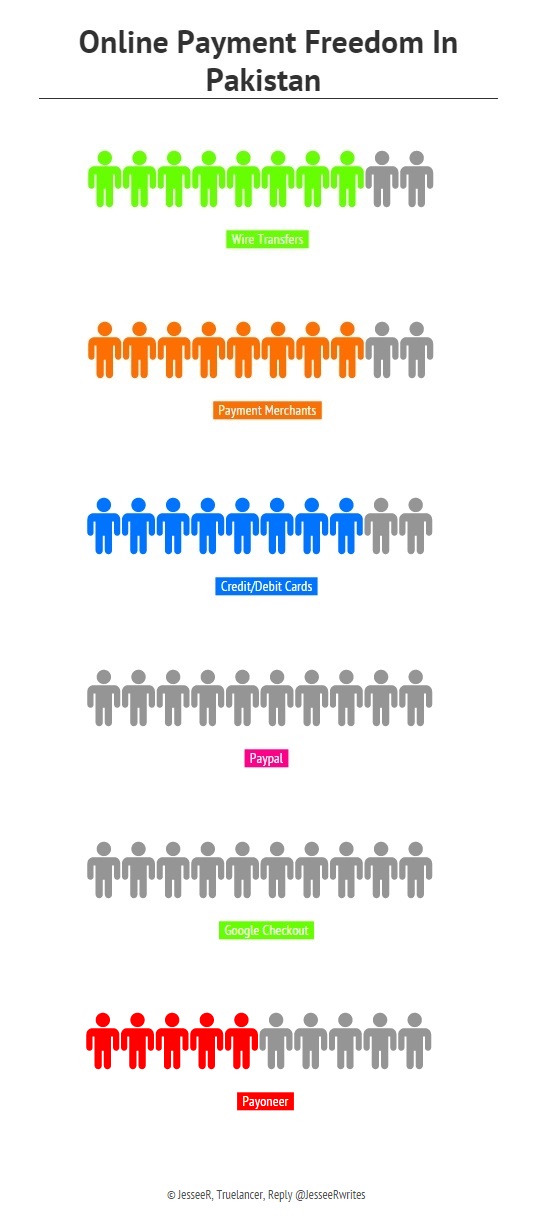

Now here is an infographic to show the extent of availability of these online freelance payment options in Pakistan.

It is clearly evident that Pakistan needs to expand its digital reach in banking and online transactions. While one can easily avail veteran methods like credit/debit cards and wire transfers and even online merchants seem to have a presence but when it comes to newer and popular channels like PayPal and Google Checkout the internet freedom is restricted as these services are not available. While this lack of accessibility can be attributed to the lack of information but it cannot be accepted as an excuse.

Thus, here Payoneer can easily be used as it is readily available.

We see a lot of freelance activity from Freelancers in Pakistan at Truelancer and many times the client has one option to pay but the freelancer does not have access to that mode of payment which limits his reach and network in the long-run. It is an issue Pakistan should quickly act upon apart from other challenges of freelancers in Pakistan.

Freelancers also should know what are the popular online payment channels across the globe

1. Direct Wire Transfers

These are the first and still very popular mode of online payment across the globe. The reasons for them being still in use are the low transaction charges, completely secure transactions guaranteed by both banks. In many countries, this is the only available mode of the transaction!

2. Online Merchants

Online payment merchants are also veterans in the field of online payment. Many merchants like Visa, Maestro and MasterCard have a reputation for providing secure online transactions and are the most used means of such payments too! They also have a low annual fee which makes them more popular as online modes of payment.

3. Credit/Debit Cards

These are the second most popular channels of online payment available to us. They have more utility as they can be used for wireless and cashless transactions in any major and above average outlet or store. They also carry nominal charges which are adjusted against your savings or any other account linked to that card.

4. PayPal

When it comes to more business to business or business to client transactions then PayPal is the world’s most widely used payment channel. It processed over $ 4 billion in payments last year. The payments are made using your existing bank account or card which is linked to your secure Paypal online account. The main attraction is that you can convert your money into any currency and carry a transaction in any country (those where PayPal is available).

The charges are a standard 2.9% + $0.30 per transaction and nothing else.

5. Google Checkout

As an answer to PayPal Google Checkout also allows users to pay for goods and services through an account connected to their Google profile. It is a very popular channel and has had an increasing number of users is because most of the people on the internet have an account on Google thus; consider it as a favourable option as it saves both time and effort.

The pricing is the same as PayPal for transactions of less than $3000. After that, the percentage slowly drops down as the volume goes up.

6. Payoneer

Payoneer is another rising platform for online transactions which is becoming increasingly popular for its simplified transfer systems. We at Truelancer recently announced that we were partnering with them to provide smooth payment and transfer systems for our increasing number of clients and freelancers.

It just requires your bank details and a swift code which is new launch in most countries and may not be available in some.

We see that these are the most popular channels which are used all across the globe to carry secure online transactions. These tools have helped clients and workers from all across the globe to connect together on a large platform and indulge in quality work relationships. This has empowered many people in remote corners of the world to gain access to the opportunities around the globe and showcase their talent.

They have given hope of monetary satisfaction to people in developing countries as freelancing has reached to very remote parts through the internet.

In our previous posts, we discussed Freelance Payment Options in India and Freelance Payment Options in Bangladesh, the other two major contributors to Asian-pacific Freelancing. What we saw can be summed up as:

- The freedom for completely secure channels like wire transfers and online merchants are great.

- The accessibility to more varied mediums like credit cards and debit cards is optimum.

- The reach of newer channels like PayPal is highest in India while in other countries, it is not available and they need to expand their digital interface. India too needs to add more freedom and empower their freelancers and e-commerce firms with more opportunities.

Read More on Truelancer Blog

A passionate Blogger and Digital Marketer

Pingback: Challenges of Freelancers in Pakistan - Truelancer Blog()